The Gaming Industry Outlook released by American Gaming Association

Wednesday 14 de May 2025 / 12:00

2 minutos de lectura

(Washington).- Real economic activity in the gaming industry fell in Q1 at the fastest rate since the pandemic as executives’ views on the current business climate softened, according to the American Gaming Association’s Gaming Industry Outlook.

Like others, AGA member companies face a landscape where consumers’ discretionary activities will be tested by tariffs on imported goods and stock market setbacks. However, even as near-term executive views have darkened, their longer-term outlook is more positive, reflecting hope that the current uncertainty will be resolved sooner than later.

The Gaming Industry Outlook provides a snapshot of the industry’s current and future economic health based on executive sentiment, gaming activity and economic indicators. Key highlights include the following:

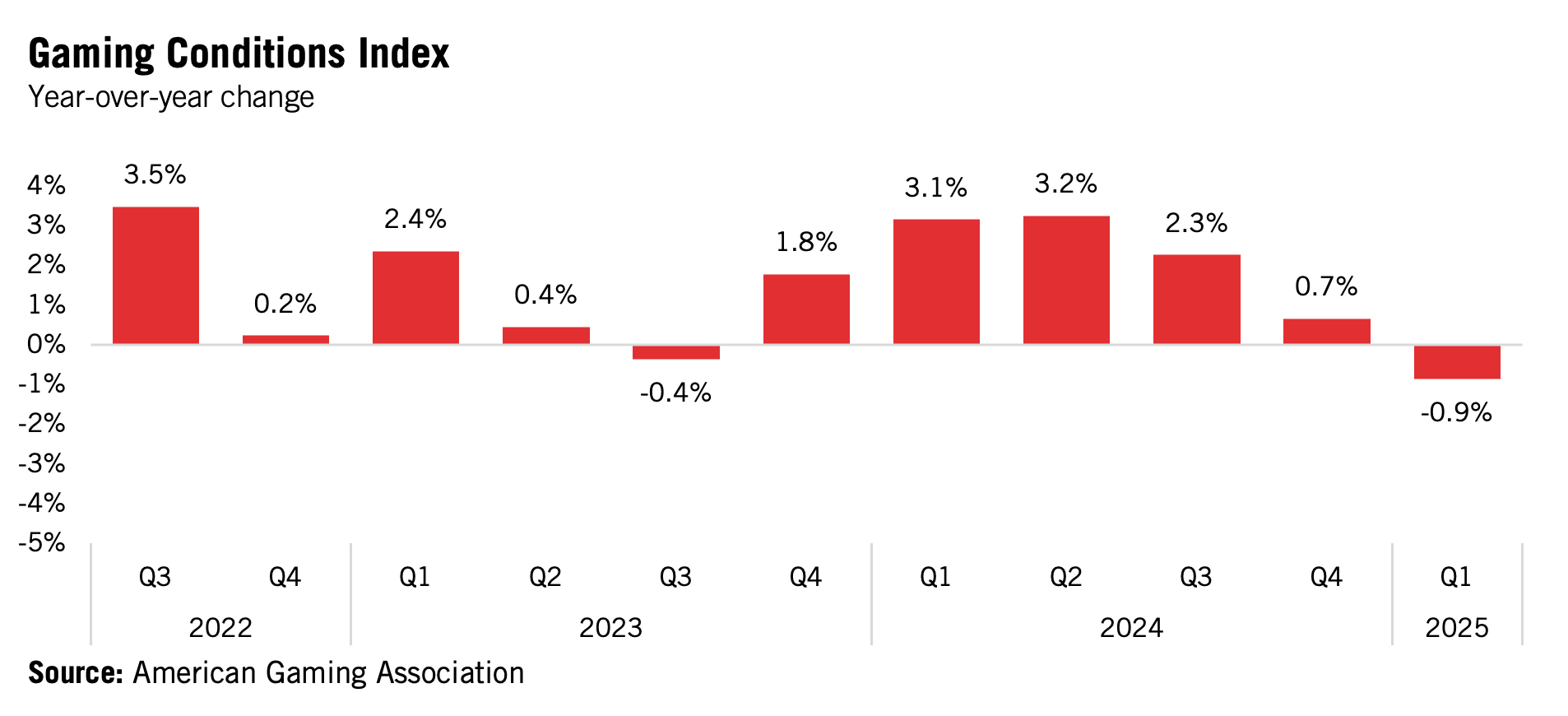

- The Gaming Conditions Index (GCI or the Index) shows real economic activity in the industry contracting in Q1 relative to the prior year. The Index tracks real economic activity in the sector, measured by gaming revenue, employment, employee wages and salaries, gaming executive sentiment, and requests for proposal (RFP) activity for events at casino hotels.

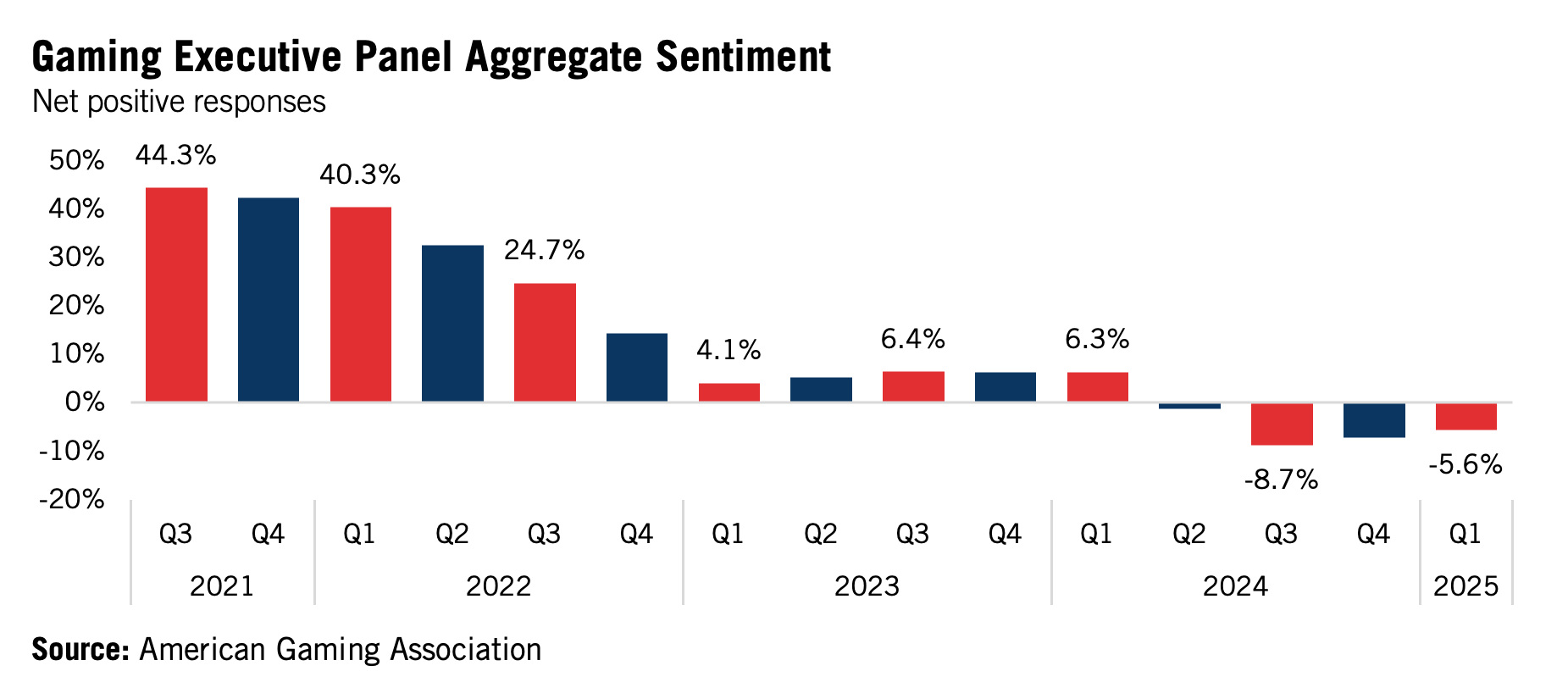

- Gaming executive sentiment improved slightly but remained marginally negative. Slightly more respondents gave negative responses (e.g., “expect decrease”) than positive ones (e.g., “expect increase”) across a range of questions pertaining to factors such as business situation, revenue growth and customer activity.

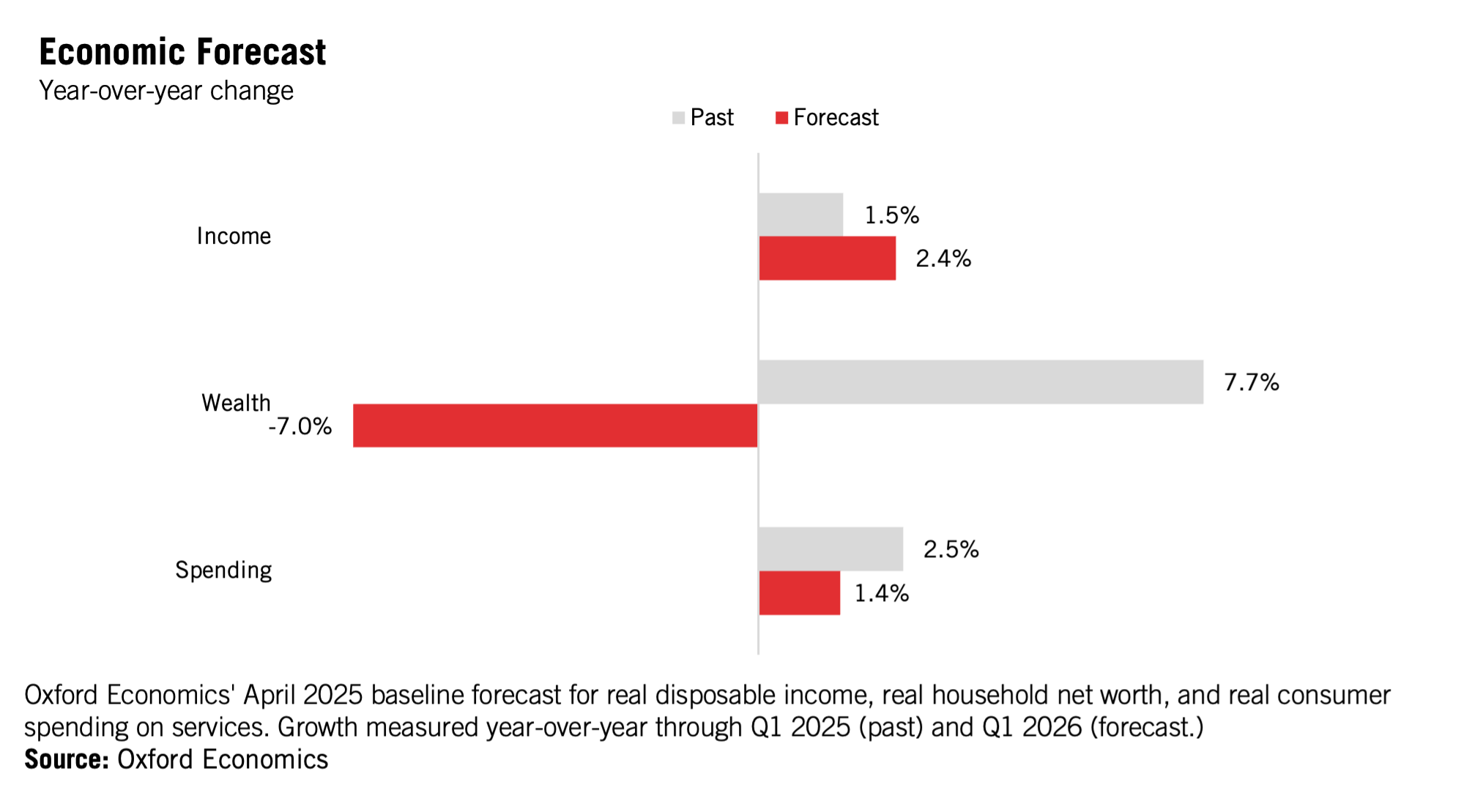

- The economic forecast is mixed but does not yet anticipate a recession. Tariffs are expected to increase the consumer price index to 3.6% this year from 3.0% last year. Combined with recent stock market declines, household sentiment is pulling back, likely presenting a headwind to discretionary spending.

Gaming Conditions Index

The GCI indicates real economic activity in the industry, as measured by gaming revenue, employment, employee wages and salaries, executive sentiment and casino hotel RFP activity declined 0.9% in Q1 2025 relative to a year earlier, the largest contraction since the pandemic. The Index decline was primarily driven by weaker real wages, marginally negative sentiment, and real below average revenue growth.

Because gaming revenues and employee wages are adjusted for inflation, the GCI was tempered by still-elevated inflation through Q1 2025.

Executive Sentiment

Gaming executive sentiment was negative at -5.6% in Q1 2025, as more respondents continued to give negative responses than positive across a range of questions pertaining to factors such as their business situation, revenue growth and customer activity. For context, when the aggregate sentiment measure is equal to zero, it means that there was an equal number of positive responses and negative responses.

The recent reading is an improvement relative to Q3 2024, as expectations around capital investment, revenue growth, and customer activity have improved. However, the score is worse than the sentiment one year ago, with the decline driven largely by negative views around the current business situation.

Note: Gaming executive sentiment is measured through a survey every other quarter, as shown by the red columns. The blue columns show smoothed estimates for non-survey quarters. Responses to the current survey were received both before and after President Trump’s April 2 tariff announcement.

Economic Outlook

The US economy is digesting multiple shocks, including tariffs, uncertainty, supply chain stress and tighter financial market conditions. Oxford Economics’ April baseline outlook assumes average tariff rates will remain at or near current levels, with an extension of the 90-day pause on certain April 2 tariff increases, resulting in a shock to the US economy, but not outright recession. In this outlook, real disposable income expands 2.4% year over year by Q1 2026, indicating household incomes outpacing stronger inflation, but household wealth declines 7.0% and real spending on services slows to just 1.4%.

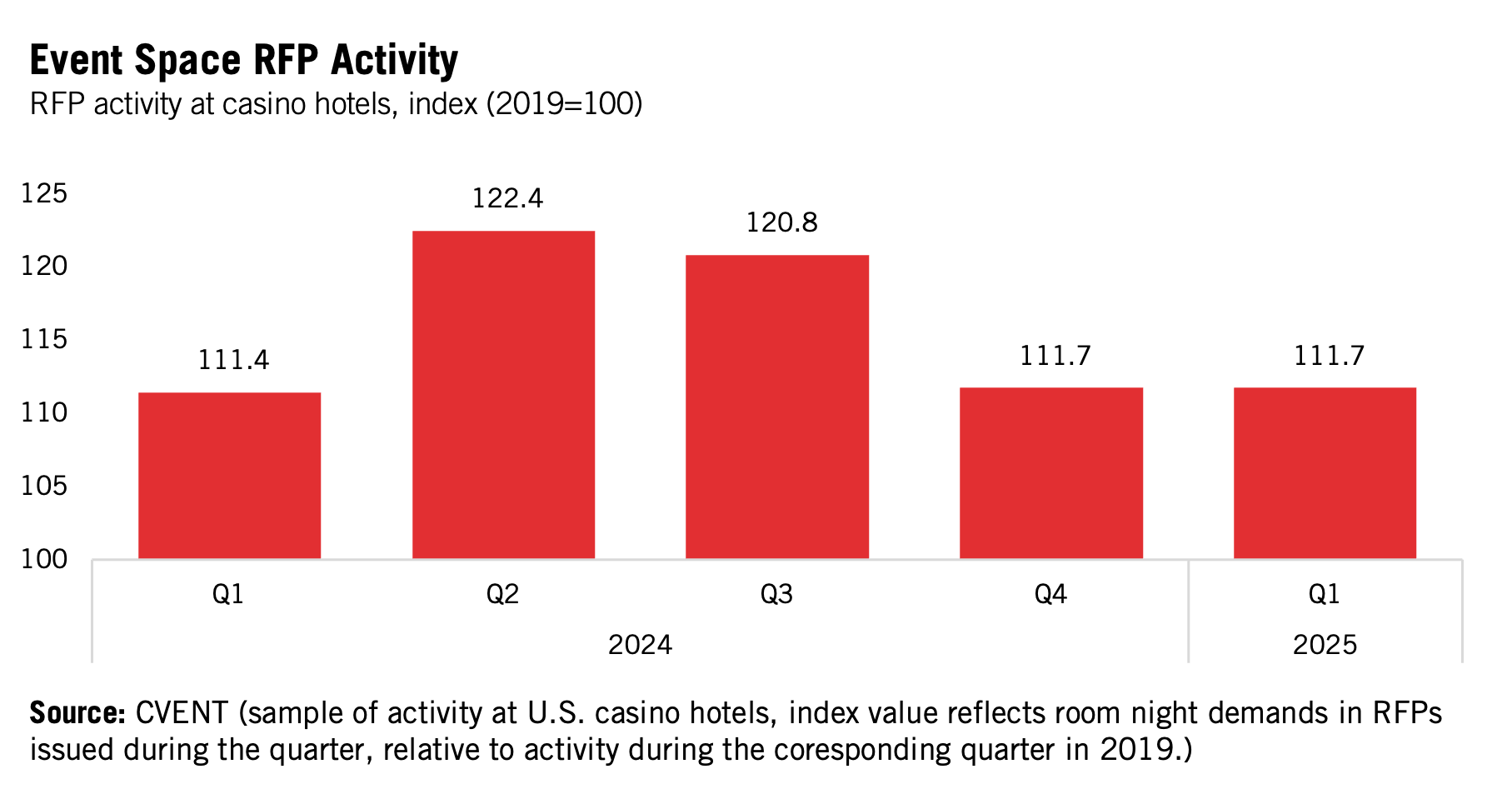

Casino Hotel Event Activity

Casino hotels continue to receive RFPs for events, such as business meetings and social events, at a pace that’s above pre-pandemic levels. Relative to a year ago, the number of RFPs received has increased by 0.3%, essentially maintaining the same level year-over-year.

Gaming Executive Panel Highlights

Despite a slight improvement in aggregate sentiment, certain conditions are limiting executive optimism. More than half of gaming executives cited economic uncertainty, inflation/interest rate concerns and geo-political risk as factors limiting their operations in the U.S. This is notably higher than Q3, when only 28% of gaming executives cited the same factors.

Rising uncertainty has driven a less positive near-term business outlook: for the first time since the survey began in 2021, more respondents indicated a negative present business situation than a positive one (36% negative, 46% neutral, 18% positive).

Despite current pessimism, executives’ longer-term outlook improved: 14% of executives responded with a positive future business outlook, 82% responded with a neutral outlook, and 4% responded with a negative outlook. This reflects expectations that revenue will grow more in the next six to 12 months than it did in the previous six to 12 months (46% positive, 28% neutral, 25% negative).

Expectations around capital investment were markedly higher: 41% of executives expect the pace of capital investment to increase, compared to 19% of gaming executives who expect a decrease. Gaming executives continued to identify hotel and food and beverage facilities as the most likely areas for investment, although the shares were lower than in 2024 Q3. (Hotel 56% in 2024 Q3, 40% in 2025 Q1; food and beverage 56% in 2024 Q3, 27% in 2025 Q1.)

Executive sentiment around future customer activity improved to its highest level since 2022 Q1, with 29% of executives expecting an increase. Insufficient customer demand, which was chosen as a factor limiting operations by 22% of executives in 2024 Q3, was only chosen by 11% of executives in 2025 Q1.

Although executives are bullish on capital investments, expectations around the pace of hiring and wage growth remain muted. Employee wages and benefits were selected along with tax or regulatory policy changes and data protection as the top areas placing additional pressure on profit margin over the next six to 12 months.

On the supplier side, gaming equipment manufacturers indicated positive expectations for sales of gaming units for new or expansion use, sales of gaming units for replacement use, and pace of capital investment for the first time since 2023 Q3.

Categoría:Reports & Data

Tags: American Gaming Association,

País: United States

Región: North America

Event

G2E - Las Vegas 2025

06 de October 2025

Air Dice Unveils 10 New Game Innovations at G2E 2025, Showcasing Volatility Control and Shifter™ Mechanics

(Las Vegas, SoloAzar Exclusive).- At G2E 2025, Air Dice made a strong impression with the debut of ten new game releases and upcoming titles. Erkki Nikunen, Partner and CBDO, highlighted the company’s focus on player-driven features. With a winter-themed “Nord Legends” booth and growing interest from sweepstakes operators, Air Dice reinforced its position as a creative force in regulated markets and Dice Placement games worldwide.

Thursday 16 Oct 2025 / 12:00

Zitro Delivers Its Most Spectacular Showcase Yet at G2E Las Vegas 2025

(Madrid).- Zitro Unveils FANTASY Cabinet and Expands Game Portfolio at G2E Las Vegas 2025.

Thursday 16 Oct 2025 / 12:00

Merkur Group Strengthens United States Presence with Successful G2E 2025 Showcase

(Lübbecke/Las Vegas).- Merkur Group marked a standout appearance at the Global Gaming Expo (G2E), attracting high visitor numbers and strong interest in its portfolio. The German gaming specialist reinforces its position in North America, presenting its extensive product range to industry professionals from around the world.

Wednesday 15 Oct 2025 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.